Imagine finding a single coin in your collection that’s valuable enough to pay off your mortgage. While most dimes are only worth 10 cents, some rare ones have skyrocketed in value, selling for hundreds of thousands of dollars at auctions. These hidden treasures are highly sought after by collectors and investors alike. If you have one of these rare dimes in your possession, you might be holding a life-changing fortune!

1. 1894-S Barber Dime – The Million-Dollar Coin

The 1894-S Barber Dime is one of the rarest and most expensive dimes in history. Only 24 were ever minted, and fewer than 10 are known to exist today. One of these dimes sold for a staggering $1.99 million in a private sale! Experts believe that a high-grade example could break records if it ever hits the auction block again. If you happen to own one, you could easily use its value to pay off a home—possibly even buy a mansion!

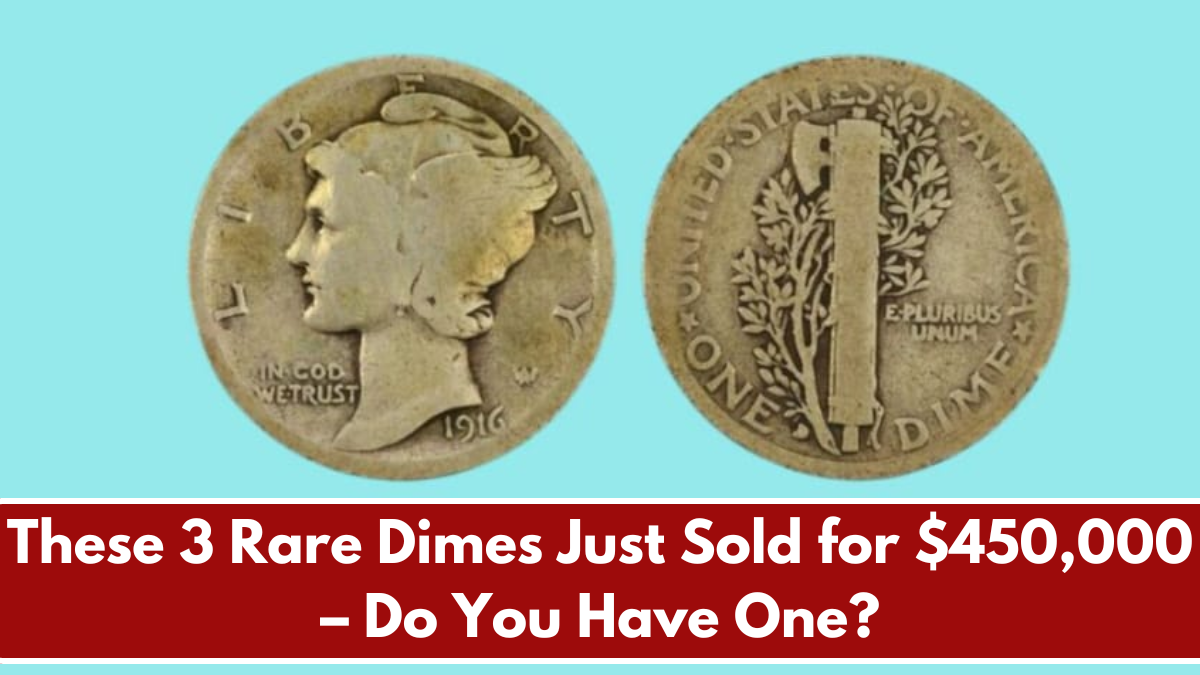

2. 1916-D Mercury Dime – A Collector’s Dream

The 1916-D Mercury Dime is another highly valuable coin, with only 264,000 pieces minted. Due to its low mintage and demand among collectors, this dime can fetch upwards of $25,000 in lower grades and over $200,000 in pristine condition. If you spot a small “D” mintmark on the back of a 1916 Mercury Dime, you might have a small fortune in your pocket!

3. 1942/1 Overdate Mercury Dime – A Minting Mistake Worth Thousands

Minting errors can make a coin significantly more valuable, and that’s exactly what happened with the 1942/1 Mercury Dime. Due to a mistake at the Philadelphia and Denver Mints, a 1942 die was stamped over a 1941 die, creating an overdate error. This rare dime is worth anywhere from $500 in worn condition to over $100,000 in mint condition. If you own one, it could bring you a huge financial windfall!

Rare dimes like these prove that small coins can hold massive value. Whether due to limited mintage, minting errors, or collector demand, these dimes are worth far more than their face value. If you’re lucky enough to own one, you might be able to pay off your mortgage or at least put a huge dent in it! Always check your change and get rare coins authenticated by a professional to ensure you’re not overlooking a potential fortune.

FAQ’s:

1. How can I tell if my dime is valuable?

Look for key features like low mintage years, minting errors, and mintmarks. Coins in good condition and those with historical significance tend to be the most valuable.

2. Where can I sell a rare dime?

You can sell your coin at auction houses, coin dealers, and online marketplaces like eBay. Getting it graded by PCGS or NGC will help increase its value.

3. How do I know if I have a 1942/1 overdate Mercury Dime?

Examine the date carefully using a magnifying glass. If you notice a faint “1” under the “2”, you may have the rare overdate variety.

4. What should I do if I find one of these rare dimes?

Avoid cleaning it, as that can lower its value. Instead, store it in a protective case and have it authenticated by a professional coin grading service.

5. Are there any other valuable dimes to look out for?

Yes! The 1874-CC Liberty Seated Dime, 1796 Draped Bust Dime, and 1968 No-S Roosevelt Dime are all highly valuable coins that collectors seek.